Accounting For Regulatory Compliances

Free up your workload with our reliable and professional accounting services that are scalable as you grow your business

Photo by Jacob Peters-Lehm on Unsplash

Choose SOAS For Quality Accounting, Reports and Tax Solutions

All-in-one Accounting and Compliance Solutions

Apart from corporate secretarial, SOAS is a one-stop ideal professional solution for your preparation of accounts, report and tax

High Quality and Speedy Services at Competitive and Affordable Prices

SOAS is equipped with Automa8e accounting software, which ensures the quality of our deliverables and meeting regulatory requirements

Consultation Services in Singapore 2025

SOAS dedicated business consultants are available to provide consultancy services on your management and business needs

Accounting Services For Better Business Management And Compliances

We, at SOAS, make sure that our Accounting helps your business succeed by giving you insights into the overall financial health of your company, offering a precise report of your cash flow, demonstrating opportunities for growth and keeping you organised and accurate when filing your annual returns and corporate taxes.

Organise digitised documents for storage & retrieval

Upload supporting documents into SOAS documa8e for data capture, accounting processing, preparation of report and tax

GST compilation for IRAS submission

Preparation of GST computation for seamless submission to IRAS

Execute and track sales and purchases

All transactions can be tracked and monitored on the dashboard

Prepare and file annual reports and annual returns

The respective documents are prepared according to IFRS for regulatory submission to ACRA

Record and reconcile transactions

Bookkeeping entries and accounting records of financial transactions are automated and reconciled with

bank statements

Compute corporate tax for online submission

Corporate taxes are computed according to IRAS requirements and filed seamlessly to IRAS

Track your collections and payments

Accounts receivables and payables schedules are available for collection and payment management

Any other services

Contact us at 6684 9199 for consultancy services regarding your needs and requirements

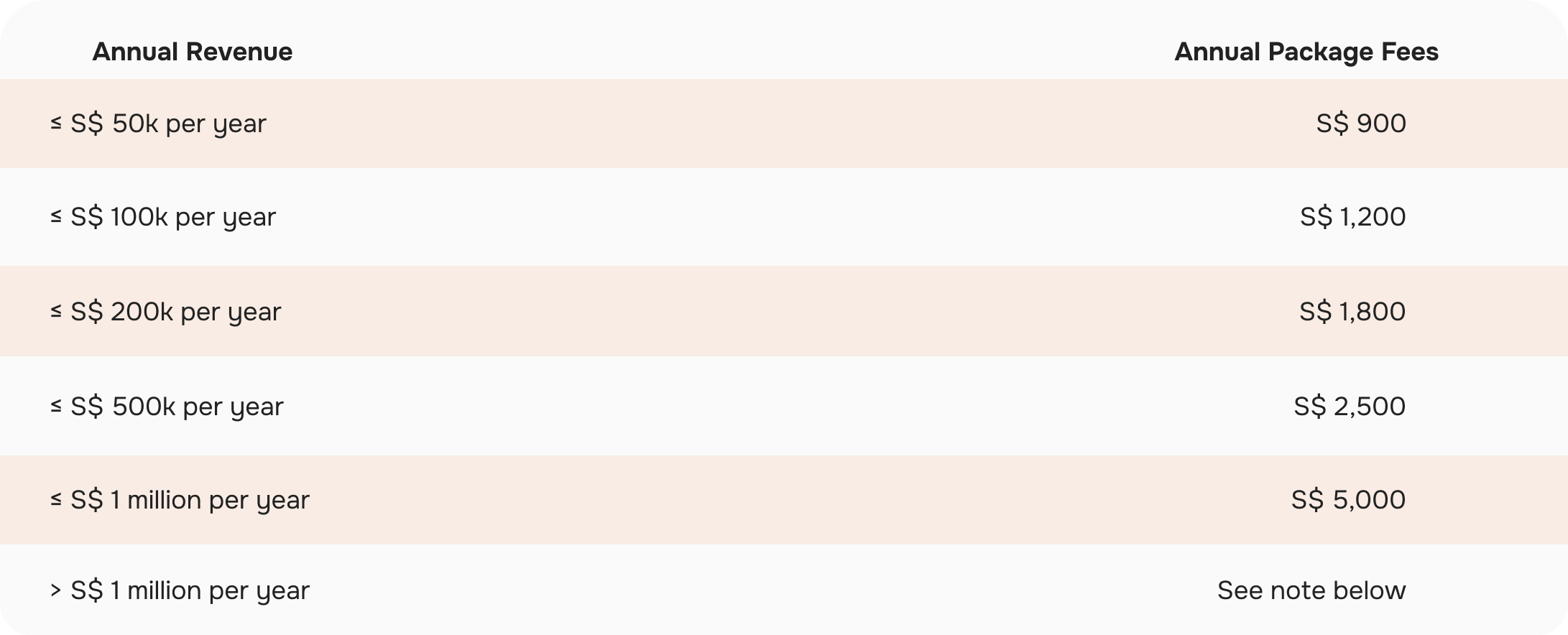

Annual Package Pricing for Accounting, Reports and Tax

The package is applicable for companies in services, wholesale trade and holding companies. Please contact us for a quote for other types of companies

*All prices are subject to 9% GST.

Note:

- GST registration is mandatory and companies need to compute GST and prepare quarterly accounts for submission to IRAS.

- Newly GST-registered businesses will be required to transmit invoice data to IRAS using InvoiceNow solutions via the InvoiceNow network from November 2025 onwards.

- For monthly or quarterly management accounting, please contact us for a direct quote and all the abovementioned requirements.

Additional Services You Might Need*

Transfer from other software

Closing of prior year accounts

Dormant company accounts

XBRL conversion

Annual multiple entities for consolidation accounting

Company incorporation in Singapore

Company Secretarial Services

Business coaching 1-2-1

CFO services

Free for the first 2 hours,

followed by S$ 50 /hr

from S$ 900 to S$ 5,000 /yr

from S$ 500 /yr

from S$ 300 /yr

from S$ 1,500 for the first 5 hours, followed by S$ 300 /hr

from S$ 350

from S$ 300 /yr

from S$ 300 /hr

from S$ 500 to S$ 3,000 /mo

Photo by Alicja Ziajowska on Unsplash

(*) All prices are subject to 9% GST.

Bookkeeping

- Monthly bookkeeping

- Multicurrency accounting

Compliance package

- Annual Unaudited Financial Statements

- Simplified XBRL report (if required)

- Annual Estimated Chargeable Income (if required)

- Annual Corporate Tax and Tax returns (Form C-S)

- Quarterly GST submissions to IRAS

Personalised service

- A dedicated accountant

- Customer success manager

- Semi-annual financial health business coaching session

Cloud Accounting software

- Operations dashboard

- Invoice management (free up to 10/month)

Reports

- Profit and Loss, Balance sheet

- Financial position

- Cash book

- Accounts payable and accounts receivable, Aged payables, Aged receivables

- Trial balance

- General ledger

- Assets and depreciation

- Accrual and deferment

Frequently Asked Questions

What Does Accounting Mean In Business?

Accounting is a methodology used in business for the systematic process of recording, summarising, analysing, and reporting financial transactions. It provides a clear picture of a company’s financial performance and position, enabling informed decision-making and compliance with regulatory requirements.

How Does Your Accounting Software Work?

Bookkeeping and accounting processing for the preparation of accounts of a company can be easily done by using Automa8e online accounting software.

You can also leverage on the use Automa8e advanced accounting software to manage your business transactions as it contains:

- Use of multiple currencies.

- Invoicing and monitor collections from your customers.

- Manage your vendors with online payment integration.

- Store digital documents online by subscribing to Documa8e, a software under Automa8e’s platform.

Can I Undertake The Accounting Tasks On My Own?

Of course you can! Our trusted Automa8e accounting software’s accountma8e module will enable you to undertake the accounting tasks independently and accurately. Using this software, once data is captured, the data processing will run automatically without the need for additional manual efforts as in most other contemporary accounting software.

What About Other Compliances Regarding Financial Reports And Tax Computations?

Once the data are captured and processed by Automa8e’s accountma8e, the financial reports and supporting schedules can be generated automatically. In addition, the tax computations can also be automatically generated for seamless submission to IRAS, the tax authorities in Singapore.

What Are The Accounting Services Deliverables For Companies?

Accounting services deliverables for companies encompass a wide range of tasks and outputs that ensure financial accuracy, compliance, and strategic decision-making. These deliverables comprise of:

- Financial Statements: Profit and loss statements, balance sheets statements and schedules, cashflow statements, aging reports and schedules.

- Bookkeeping: Recording daily financial transactions and maintaining ledgers and journals for accurate financial records.

- Tax Services: Preparing and filing tax returns, tax planning to optimise liabilities and ensure compliance with regulations.

- Payroll Management: Processing employee salaries, benefits, and deductions, ensuring timely payroll tax filings

- Month-End/Quarterly/Year-End Close: Reconciling accounts payable (AP) and accounts receivable (AR), reviewing bank statements for accuracy and closing books to prepare monthly/quarterly/annual reports.

What Is The Current Corporate Tax Rate In Singapore?

Tax on corporate income is imposed at a flat rate of 17% currently.

A partial tax exemption and a three-year start-up tax exemption for qualifying start-up companies are available.

Please refer to IRAS’s platform for further information.

Is GST Registration Mandatory?

Singapore companies are required by law to register for GST when their taxable turnover exceeds S$1 million. However, other companies that do not exceed the taxable turnover of S$1 million, may still choose to voluntarily register for GST. All GST-registered companies are required to charge GST and file GST returns. Once registered, a company must remain registered for at least 2 years.

What Is The Price Of SOAS Accounting Services?

Our prices are very competitive and there is a wide range of services and products for you to choose from depending on your needs. Check our pricing here.