Accounting and Tax Solutions for Services Companies

We bring together accounting expertise coupled with industry knowledge and innovative business automation software to power your growth and bring a higher return on investment. Get started

Our solutions for Services Companies

Professional Accounting Services

Free up your workload with our reliable and professional accounting services that are scalable as your business grows

Management Reporting Services

Use accurate and timely reports to track operation performance and cash flows for improved business management decisions

Business Advisory Services

Get the guide on improving your business processes and begin driving true value, eliminate inefficiencies and reduce cost

Rated excellent by our customers via Google reviews

Our customers say Excellent ⭐⭐⭐⭐⭐ 5 out of 5 based on 148 Google reviews

Who we serve

We, at SOAS, make sure that our Accounting helps your Service Business succeed by giving you insights into the overall financial health of your company, offering a precise report of your cash flow, demonstrating opportunities for growth and keeping you organized and accurate when filing your taxes.

Management

Consultancy

Advisory

Training and Coaching

Engineering Design

Interior Design

Software Development

Marketing

Management

Consultancy

Advisory

Training and Coaching

Engineering Design

Interior Design

Software Development

Marketing

Solutions tailored to service companies

Sale Receivable and Collection Management

Investment Management

Right of Use Management

Bill Payable and Payment Management

Inventory Management

Multiply currencies

Asset Management

Loans and Finance Lease Management

Equity Managements

Solutions tailored to wholesale companies

Sale Receivable and Collection Management

Bill Payable and Payment Management

Asset Management

Investment Management

Inventory Management

Loans and Finance Lease Management

Right of Use Management

Multiply currencies

Equity Managements

Make decisions based on real-time data with our cloud accounting software - Automa8e

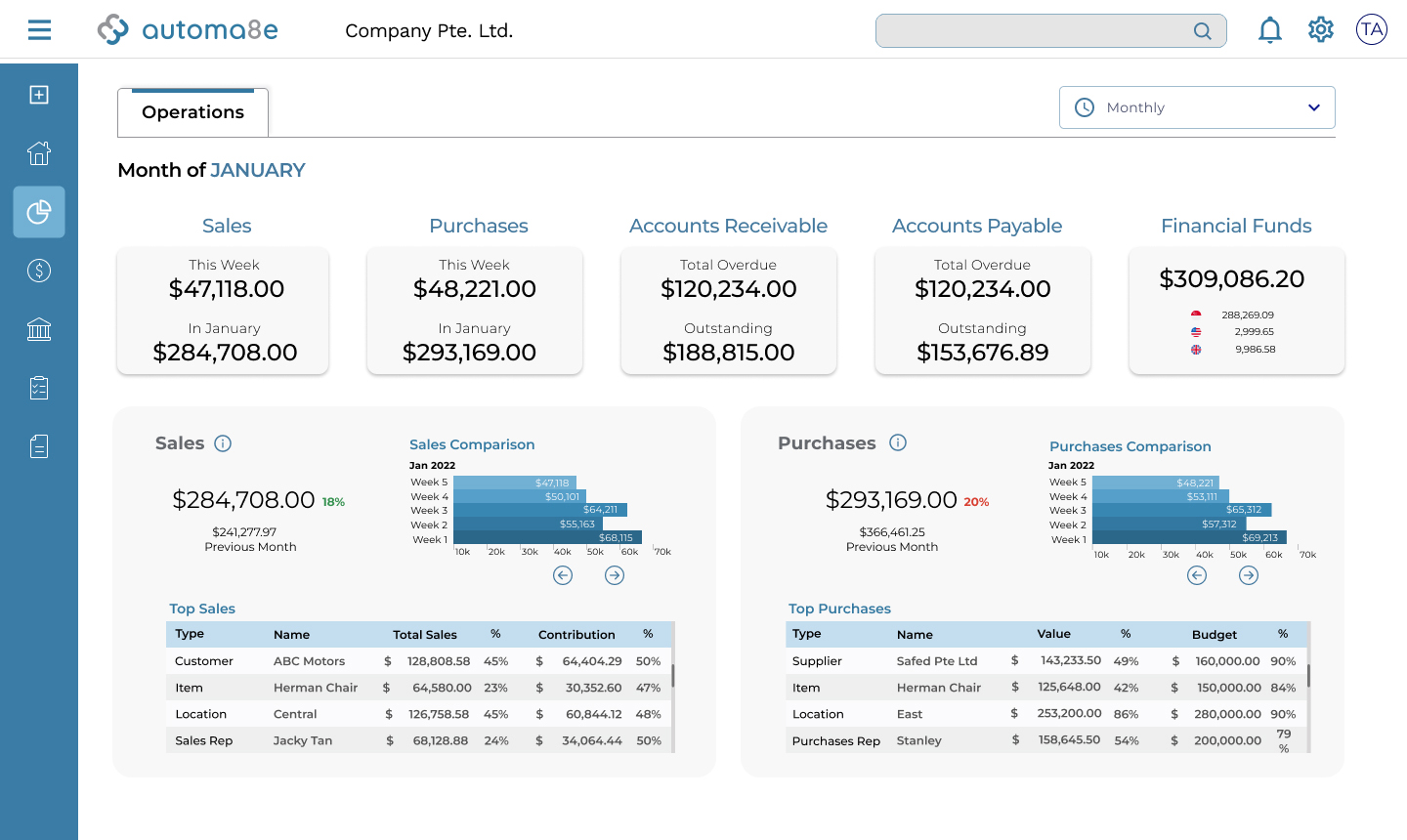

Dashboard with overview of your business

Review the overall performance of your business with Automa8e’s dashboard. Each employee will have access only to the relevant information according to their roles.

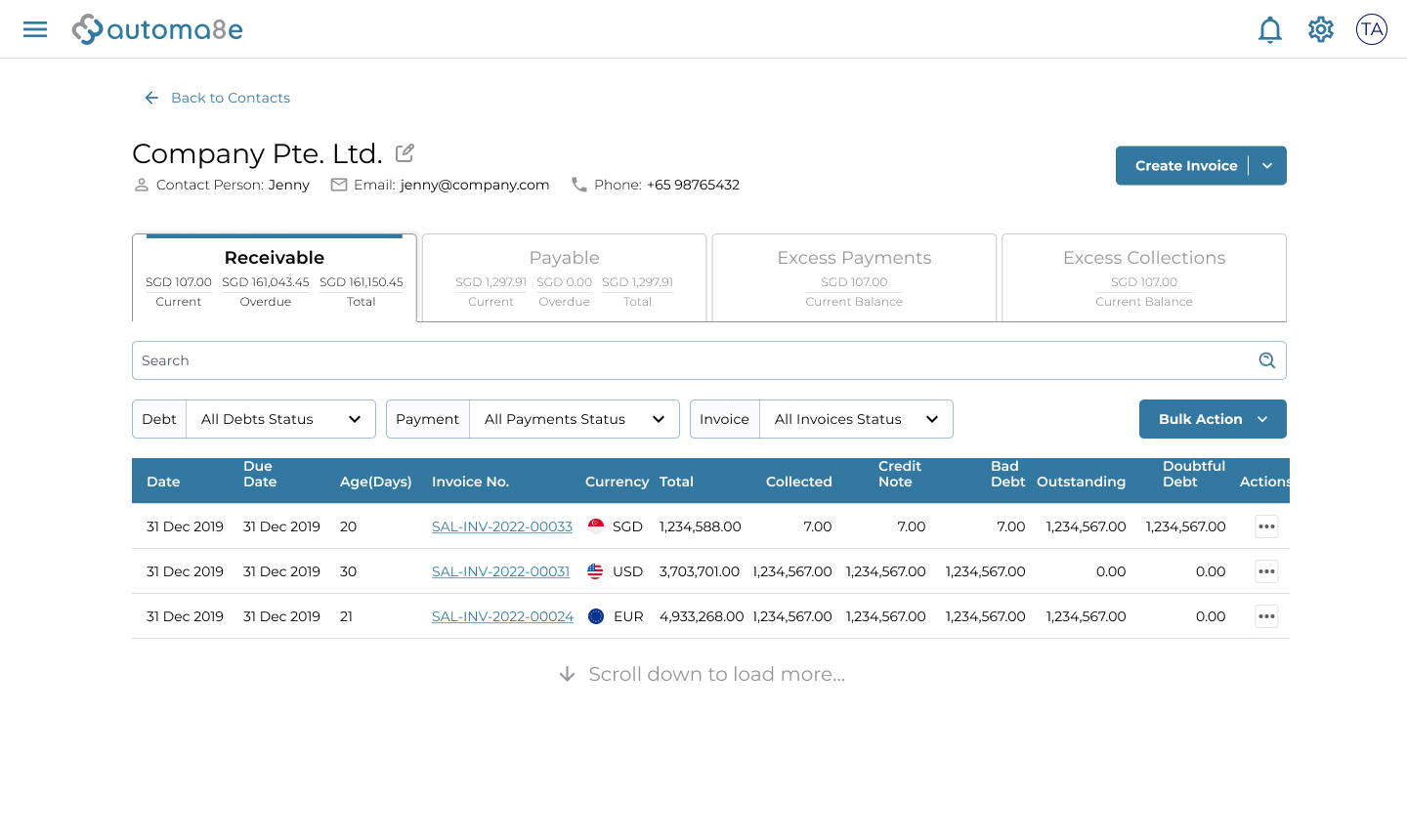

Sales and collections made more accessible

Track all receivables and payables in one dashboard while issuing sales invoices and recording collections in any currency you need. In addition, forecast collections to better manage your cash funds.

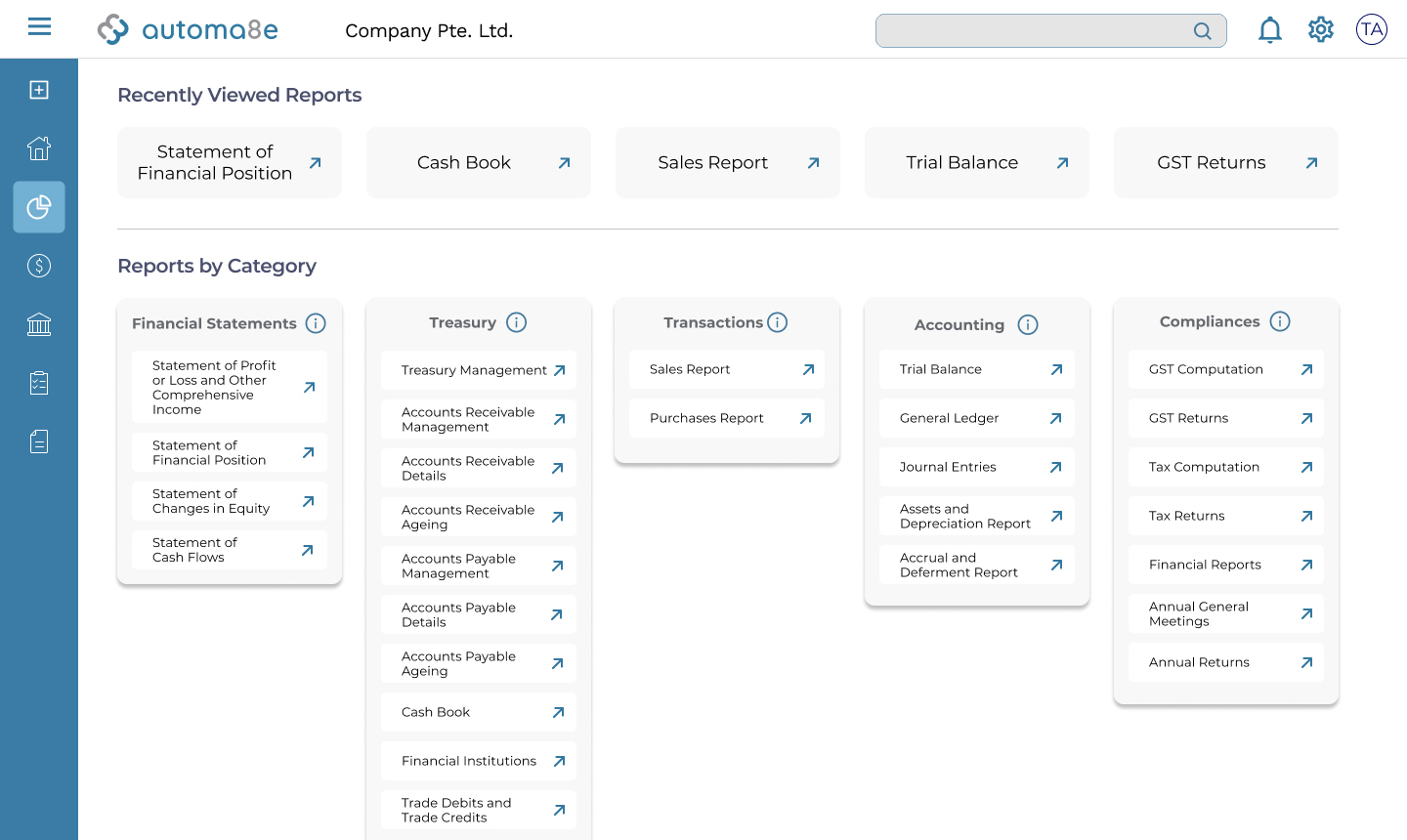

Focus on the most important Business Reports

Make more accurate and data-driven decisions with our BI reports and stay informed about the performance of the business in several areas and departments. We also created reports and schedules, especially for your accountants to ease their workload too.

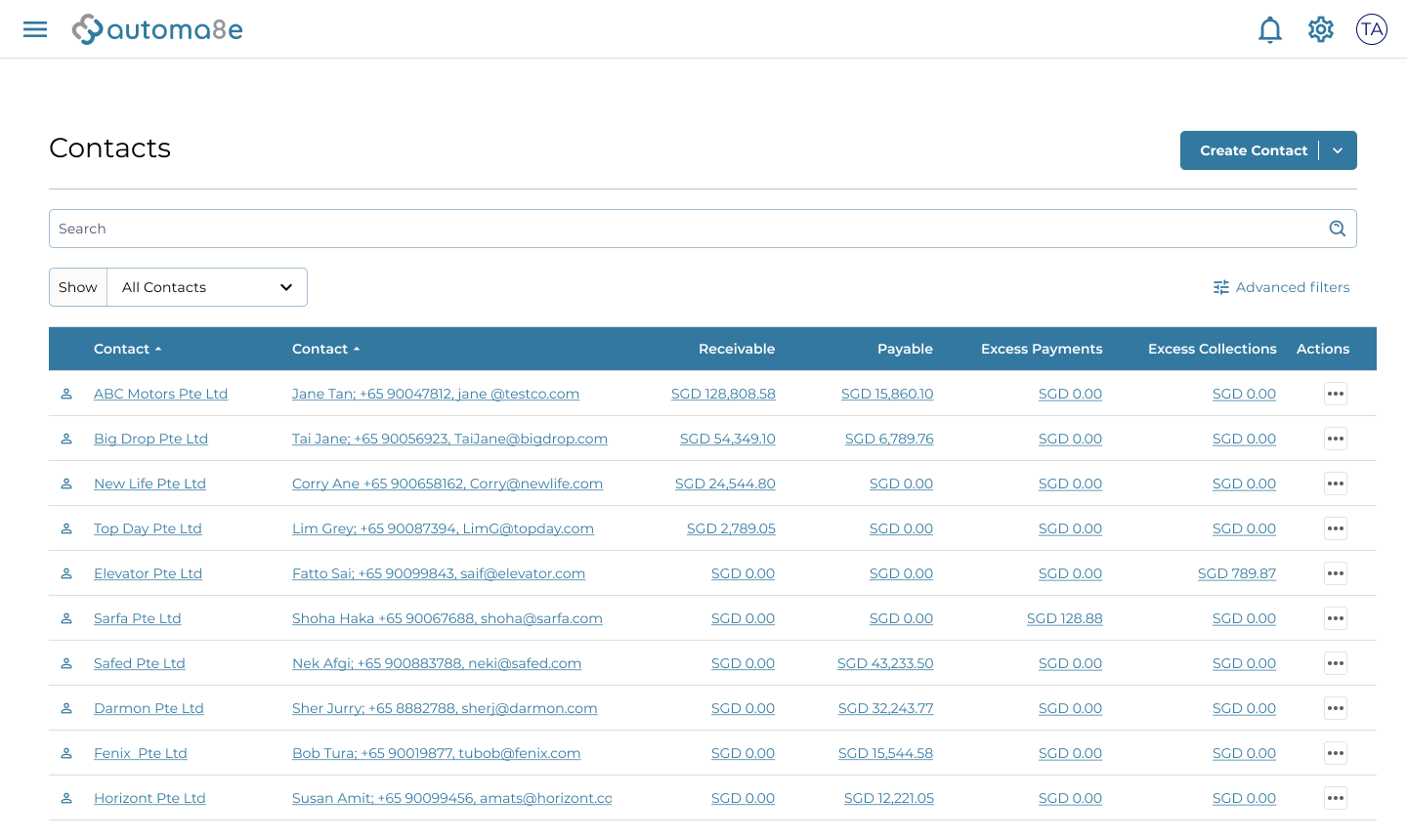

Manage your customers and suppliers in one place

Navigate between contact persons and shipping addresses easily by adjusting your documents as per your current needs. Your customers and suppliers are now all in one place with no duplicates anymore.

Own accounting software with management reports - always free for up to 10 invoices and 10 bills a month

Why Our Clients Choose SOAS

We Are Highly Efficient

We have a highly dedicated team which focuses on each customer as a sole project, committed to achieving their goals in the quickest way possible.

We Are Easily Approachable

Our support team is available and flexible with client needs, to ensure we deliver great customer services. Your success is our top priority.

We Are Secure and Reliable

Our reliability is measured by our results. We build relationships based on transparency, trust and accountability with our employees and customers.

On top of that, we help with Business Solutions

Annual Package Pricing for Accounting, Reports and Tax

The package is applicable for companies in services, wholesale trade and holding companies.

Please contact us for a quote for other types of companies

Additional services you might need

Transfer from other software

Closing your previous years

Company secretary

Company incorporation in Singapore

Business coaching 1-2-1

Group business workshops

CFO services

Multiple entities consolidation accounting

free if takes up to 2h of our time then S$50 / hour

from S$ 900

from S$ 288 / year

from S$ 348

from S$ 300 / hour

from S$ 300 / lesson

from S$ 300 / hour

from S$ 1800 per entity

*All prices are subject to 9% GST

Transfer from other software

free if takes up to 2h of our time then S$50/ hour

Closing your previous years

from S$ 900

Company secretary

from S$ 288/ year

Company incorporation in Singapore

from S$ 348

Business coaching 1-2-1

from S$ 300 / hour

Group business workshops

from S$ 300 / lesson

CFO services

from S$ 300/ hour

Multiple entities consolidation accounting

from S$ 1800 per entity

*All prices are subject to 9% GST

Bookkeeping

- Monthly bookkeeping

- Multicurrency accounting

Compliance package

- Annual Unaudited Financial Statements

- Simplified XBRL report (if required)

- Annual Estimated Chargeable Income (if required)

- Annual Corporate Tax and Tax returns (Form C-S)

- Quarterly GST submissions to IRAS

Personalised service

- A dedicated accountant

- Customer success manager

- Semi-annual financial health business coaching session

Cloud Accounting software

- Operations dashboard

- Invoice management (free up to 10/month)

Reports

- Profit and Loss, Balance sheet

- Financial position

- Cash book

- Accounts payable and accounts receivable, Aged payables, Aged receivables

- Trial balance

- General ledger

- Assets and depreciation

- Accrual and deferment

Frequently asked questions

What does accounting mean in business?

Accounting is how your business records, organizes, and understands its financial information.

What is the role of accounting services for small business?

Preparing and maintaining important financial reports. Preparing profit and loss statements, tax returns, IRAS income tax, and ensuring that taxes are paid properly and on time. Evaluating financial operations to recommend best practices, identify issues and strategize solutions, and help organizations run efficiently.

How much does accounting services cost in Singapore?

Some firms, for instance, charge as much as S$300–S$400 monthly for low volume transactions. Small to medium volume transactions may incur a monthly fee of S$500 to S$800, while high volume transactions may incur a fee of S$1500 or more

Where can I check my income tax Singapore?

You can access your federal tax account through a secure login at IRS.gov/account. Once in your account, you can view the amount you owe along with details of your balance, view 18 months of payment history, access Get Transcript, and view key information from your current year tax return.

What are the current tax rates in Singapore?

Tax on corporate income is imposed at a flat rate of 17%.

A partial tax exemption and a three-year start-up tax exemption for qualifying start-up companies are available.

Partial tax exemption (income taxable at a normal rate):

First S$ 10,000 chargeable income:

– Exempt from tax: 75%

– Exempt income: S$ 7,500

Next S$190,000 chargeable income:

– Exempt from tax: 50%

– Exempt income: S$ 95,000

Start-up tax exemption* (income taxable at a normal rate):

First S$ 100,000 chargeable income:

– Exempt from tax: 75%

– Exempt income: S$ 75,000

Next S$ 100,000 chargeable income:

– Exempt from tax: 50%

– Exempt income: S$ 50,000

*The start-up exemption is not available to property development and investment holding companies.

Is GST mandatory in Singapore?

Singapore companies that exceed a certain threshold for their GST-applicable revenue (referred to as taxable turnover) are required by law to register for GST Singapore. Other companies that don’t exceed the revenue threshold are not required to register for GST but can still register voluntarily if it suits them. All GST-registered companies are required to charge GST and file GST returns. Once registered, a company must remain registered for at least 2 years.

Who pays GST in Singapore?

GST is only charged by GST-registered businesses. A business must register for GST if its annual turnover exceeds S$1 million. For small businesses that do need meet this threshold, GST registration is optional.

Who should pay IRAS income tax in Singapore?

Individuals resident in Singapore are taxed on a progressive resident tax rate as listed below. Filing of personal tax return for tax resident is mandatory if your annual income is S$20,000 or more. Tax residents do not need to pay tax if your annual income is less than S$20,000:

First S$20,000 – 0%

Next S$10,000 (up to S$30,000) – 2%

Next $S10,000 (up to S$40,000) – 3.5%

Next S$40,000 (up to S$80,000) – 7%

Next $S40,000 (up to S$120,000) – 11.5%

Next S$40,000 (up to S$160,000) – 15%

Next S$40,000 (up to S$200,000) – 18%

Next S$40,000 (up to S$240,000) – 19%

Next S$40,000 (up to S$280,000) – 19.5%

Next S$40,000 (up to S$320,000) – 20%

Above S$320,000 – 22%

What's the difference between accounting and bookkeeping?

While bookkeeping is all about recording of financial transactions, accounting deals with the interpretation, analysis, classification, reporting and summarization of the financial data of a business.

What is included in the accounting services?

Accounting services include tax preparation and counseling, as well as tracking spending and earnings. Accounting is concerned with preserving accurate financial records and implementing effective recordkeeping systems.