What Is the Unique Entity Number (UEN)?

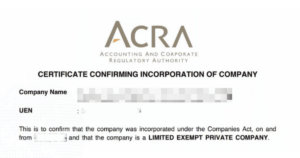

The Unique Entity Number (UEN) is a key identifier issued by the Singapore government to registered business entities. Think of it as a “business passport,” enabling companies to interact seamlessly with government bodies and private institutions. Assigned upon registration with the Accounting and Corporate Regulatory Authority (ACRA) or other relevant agencies, the UEN ensures each business has a permanent, unique number for streamlined identification.

Much like the National Registration Identity Card (NRIC) for individuals, the UEN acts as the primary reference point for businesses in Singapore. Whether you are registering a sole proprietorship, a limited liability partnership (LLP), or a local company, your UEN will reflect your entity type and provide a unified way to engage with regulatory bodies and service providers.

For anyone looking to establish a business in Singapore, understanding the UEN and its significance is crucial to navigating the country’s business ecosystem.

UEN Composition and Format

The format of a UEN depends on the type of entity and the year it was registered. Entities registered after 2009 receive a UEN with a 10-character format: TyyPQnnnnX. Entities registered before 2009 have a slightly different format consisting of 9 characters: nnnnnnnnX.

For local companies registered after 2009, the UEN follows the format yyyynnnnnX. This unique composition includes identifiers such as the year of registration and an entity-type indicator, which provides additional information about the business. For example, “LL” denotes Limited Liability Partnerships. Foreign entities, representative offices, and other non-traditional entities have their own unique formats that incorporate details such as the year of issuance and entity type.

A crucial element of the UEN is its suffix, a check alphabet that validates the authenticity of the number. This feature ensures that entities can communicate accurately and securely with ACRA and other agencies.

UEN Issuance Agencies

While ACRA is the primary agency responsible for issuing UENs, other government bodies also handle UEN issuance for specific entity types. For instance, foreign trade associations and chambers of commerce are issued UENs by Enterprise Singapore. Law practice representative offices receive their UENs from the Ministry of Law, while religious entities such as mosques and madrasahs are issued UENs by the Islamic Religious Council of Singapore. This system ensures that all types of entities, from local businesses to foreign representative offices, are covered comprehensively.

Each UEN-issuing agency aligns with the specific regulatory needs of the entities under its purview. This structure allows businesses to operate smoothly within their respective industries while maintaining compliance with Singapore’s regulatory framework.

How to Apply for a UEN

Obtaining a UEN is a standard part of the business registration or incorporation process in Singapore. When an entity registers with ACRA or other relevant agencies, a UEN is automatically assigned. Businesses also have the option to request a Special UEN (SUN) for an additional fee. These numbers are designed to be more memorable and can serve as an effective branding tool.

Foreign entities follow a slightly different process. Representative offices, foreign trade bodies, and similar entities apply for their UENs through the relevant agency based on their nature of operations. Regardless of the entity type, the process is designed to be seamless and efficient, ensuring that businesses can quickly obtain their UEN and begin operations.

Utilising the UEN

The UEN is much more than a registration number. It serves as a central tool for simplifying administrative processes and improving operational efficiency. Businesses use their UEN to interact with government agencies, such as filing corporate tax returns, applying for permits, and registering for digital services offered by the Government Technology Agency (GovTech).

Another important application of the UEN is its integration with financial systems like PayNow Corporate. By linking their UEN to their bank accounts, businesses can facilitate seamless and secure financial transactions. PayNow Corporate even allows for QR code-based payments, streamlining the payment process for both businesses and their clients.

Searching for and Verifying a UEN

Businesses or individuals can search for and verify UENs using the Singapore Online Search Directory. This tool allows users to input details such as the company name to retrieve key information, including the UEN, issuance agency, and entity type. This feature is especially useful for verifying the legitimacy of businesses and ensuring accurate communication with government bodies.

Legal Requirements for Displaying a UEN

Entities in Singapore are legally required to display their UEN on various official documents. These include invoices, receipts, business letterheads, and correspondence with government agencies. Additionally, businesses must include their UEN on marketing materials such as brochures, leaflets, and websites. For digital platforms, displaying the UEN or a QR code for payments is highly encouraged to ensure transparency and convenience.

Keeping UEN Information Updated

Although the UEN itself is permanent and cannot be changed, businesses are responsible for keeping their associated information, such as registered addresses or business activities, up to date. Updates can be made through platforms like ACRA’s BizFile system, ensuring that businesses remain compliant with regulatory requirements. Timely updates also facilitate smooth communication with government agencies and service providers.

Exemptions and Special Cases

While the UEN is mandatory for most entities in Singapore, there are certain exemptions. For example, entities involved in one-off transactions or offshore companies without local operations are not required to obtain a UEN. Additionally, sub-entities such as branches or divisions may use sub-entity codes instead of obtaining a separate UEN. Special UENs, meanwhile, are available for businesses seeking a more recognisable and prestigious identifier.

Benefits of Having a UEN

The UEN simplifies the operational and administrative aspects of running a business in Singapore. By providing a unified identifier, it reduces the need for multiple registration numbers when interacting with government agencies. This not only streamlines processes like tax filing and permit applications but also enhances efficiency and transparency in business operations.

The ability to link the UEN with financial systems like PayNow Corporate further highlights its versatility, enabling businesses to conduct financial transactions with ease and security.

FAQs About About Unique Entity Number (UEN)

Q. What is a Unique Entity Number (UEN)?

A UEN is a unique identification number assigned to businesses, organizations, and other entities in Singapore upon registration. It is used to simplify interactions with government agencies and streamline business processes.

Q. Who is required to have a UEN?

All registered entities in Singapore, such as companies, sole proprietorships, partnerships, LLPs, societies, and representative offices, must have a UEN. Individuals and unregistered entities are not issued a UEN.

Q. How is the UEN issued?

The UEN is automatically assigned during the business registration process with ACRA or other relevant UEN issuance agencies like the Ministry of Law, Enterprise Singapore, or MUIS.

Q. Can I change my UEN?

No, a UEN is permanent and cannot be changed, even if the business name or structure is altered. If a new entity is formed, a new UEN will be issued.

Q. What is a Special UEN (SUN)?

A Special UEN (SUN) is a customizable UEN that businesses can choose for an additional fee. These are often selected for their memorability and branding purposes.