Table of Contents:

Introduction

1 Using personal bank accounts to pay for business expenses

How to fix this

2 Failing to Keep Track of Receipts and Bills

To prevent this:

3 Neglecting Bank Reconciliations

Best practices:

4 Missing Regulatory and Tax Deadlines

How to stay compliant:

5 Delaying the Adoption of an Accounting System

Get ahead of this by:

Conclusion

Introduction

Ever wonder why so many startup founders face financial trouble despite making healthy sales? The issue isn’t always with the revenue—common accounting mistakes often derail growth and cause bigger financial issues. This article covers five frequent accounting errors that startup founders must avoid to stay financially healthy and grow smoothly.

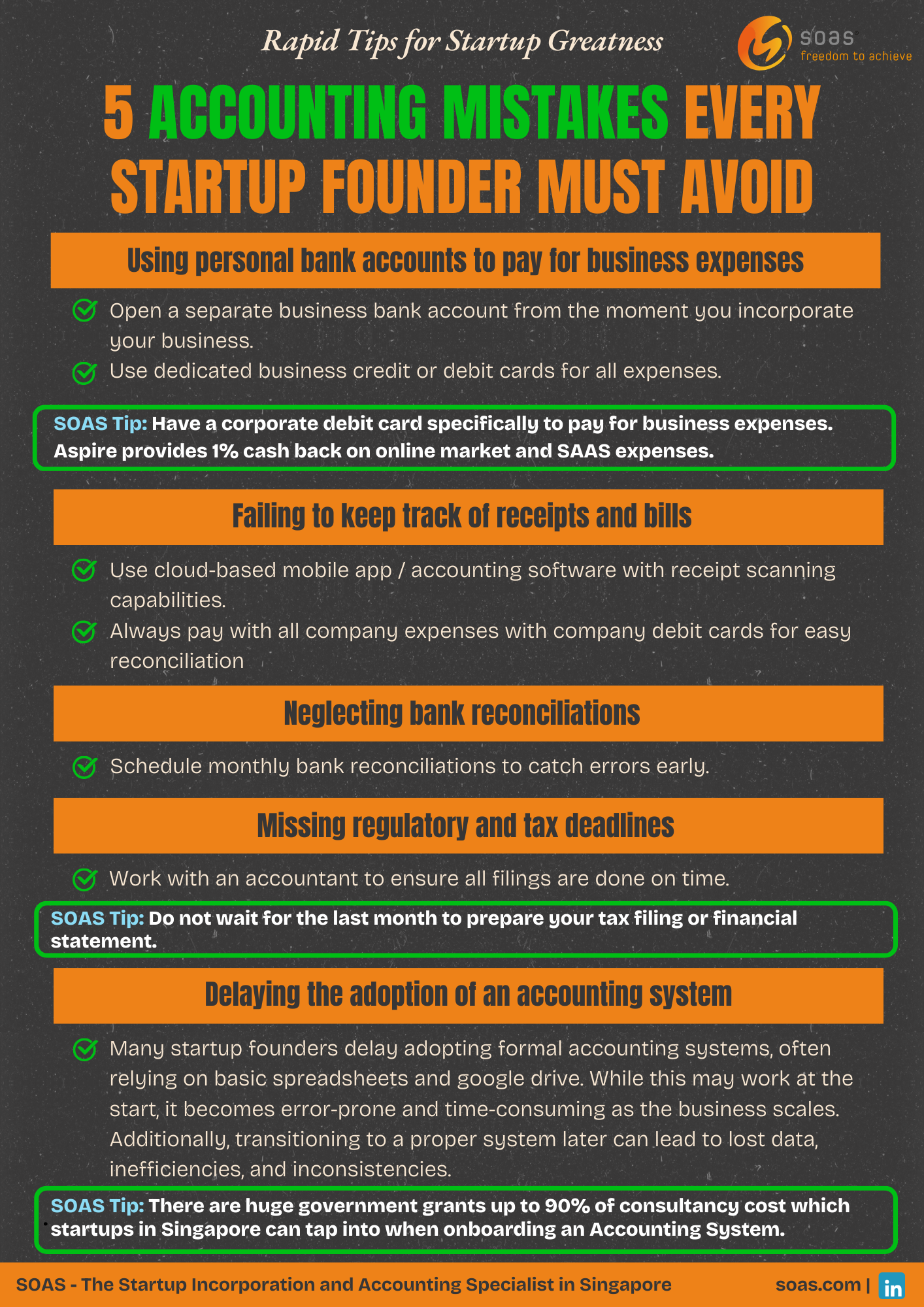

Using personal bank accounts to pay for business expenses

A frequent mistake among new startup founders is using personal bank accounts for business expenses. This can lead to a major headache when it’s time to prepare financial statements. If personal and business finances are tangled, it becomes incredibly difficult to track what’s what. Plus, tax authorities may scrutinize your business for improper record-keeping.

Example: A freelance designer in Singapore used her personal credit card for both business and personal expenses. When preparing her financial statements, she struggled to differentiate business transactions, which led to a complicated tax filing process and potential tax deductions being missed.

How to fix this:

- Open a separate business bank account from the moment you incorporate your business.

- Use dedicated business credit or debit cards for all expenses.

- Track expenses carefully using accounting software to ensure clear boundaries between personal and business transactions.

SOAS Tip: Have a corporate debit card specifically to pay for business expenses. Aspire provides 1% cash back on online market and SAAS expenses.

Failing to Keep Track of Receipts and Bills

It’s easy to get caught up in the daily grind and forget to track every bill or receipt. However, failing to document transactions can lead to inaccurate records, missed tax deductions, and even compliance issues during an audit. A small oversight here can turn into a major problem later.

Example: A café owner in Singapore failed to track their utility and small equipment purchases. As a result, they were unable to claim these expenses as tax deductions, missing out on potential savings.

To prevent this:

- Use cloud-based mobile app / accounting software with receipt scanning capabilities.

- Always pay with all company expenses with company debit cards for easy reconciliation

- Set a monthly schedule to review and organize receipts.

SOAS Tip: Untracked small expenses can accumulate over time and significantly impact your cash flow and tax reporting. Stay diligent with documentation.

Neglecting Bank Reconciliations

Regularly reconciling your bank statements ensures that your financial records accurately match the money flowing in and out of your business. Skipping this process can lead to unnoticed errors, including fraudulent transactions or double payments, and result in inaccurate financial reporting.

Example: A small retail store in Singapore missed out on detecting double payments made to a vendor because they hadn’t reconciled their bank statements for several months. This mistake cost them thousands of dollars before it was caught.

Best practices:

- Schedule monthly bank reconciliations to catch errors early.

- Use accounting software that automates reconciliations and flags inconsistencies for you.

- Train your staff to follow reconciliation procedures regularly to ensure that all financial records are accurate.

SOAS Tip: Regular reconciliations ensure financial accuracy and can save your business from losing money to unnoticed errors.

Missing Regulatory and Tax Deadlines

Tax and regulatory deadlines in Singapore are strict, and failing to meet them can result in hefty fines, penalties, and interest charges. Beyond the financial costs, your business’s reputation can suffer, particularly with the Inland Revenue Authority of Singapore (IRAS).

Example: A logistics company missed the deadline for their corporate tax submission, resulting in fines and additional interest charges, which affected their profit margins.

How to stay compliant:

- Mark tax deadlines like Goods and Services Tax (GST) filings and corporate tax returns on your calendar.

- Set up reminders using task management apps like Asana or Google Calendar.

- Work with an accountant or bookkeeper to ensure all filings are done on time.

SOAS Tip: Do not wait for the last month to prepare your tax filing or financial statement.

Delaying the Adoption of an Accounting System

Many startup founders delay adopting formal accounting systems, often relying on basic spreadsheets and google drive. While this may work at the start, it becomes error-prone and time-consuming as the business scales. Additionally, transitioning to a proper system later can lead to lost data, inefficiencies, and inconsistencies.

Example: A food delivery startup in Singapore postponed switching to a cloud-based accounting system and ended up with discrepancies in financial reports, which took weeks to resolve.

Get ahead of this by:

- Implementing an accounting system early, even before your business fully scales.

- Use scalable software that can grow with your business.

- Transition to cloud-based systems to ensure data is securely stored and easily accessible.

SOAS Tip: There are huge government grants up to 90% of consultancy cost which startups in Singapore can tap into when onboarding an Accounting System

Conclusion

Accounting mistakes are easy to make, but their consequences can be damaging. Avoiding these five common errors will help startup founders maintain accurate financial records, remain compliant, and thrive in the long run. Whether it’s adopting the right software early or staying on top of your regulatory deadlines, setting up good accounting habits now will save you time and headaches later.

If you need help streamlining your business accounting processes, reach out to SOAS today for expert guidance on implementing best accounting practices.